주식 거래 부서 - 이번 주 추천 주식 WPM

- 7월 1, 2025

- Posted by: admin@gmail.com

- Category: Cryptocurrency

1. Investment Classification

WPM is a mid-to-large cap precious metals streaming company, falling under the commodities (gold & silver) sector. Its business model offers stable cash flows and low cyclicality, making it a compelling alternative asset—ideal as a defensive allocation within a traditional equity portfolio.

2. Business Model Breakdown

Strong Competitive Moat through Streaming Model: WPM doesn’t engage in mining operations directly. Instead, it signs long-term contracts with mining companies, providing upfront capital in exchange for rights to purchase future gold and silver production at fixed, discounted prices. This asset-light model reduces operational risk and delivers high profit margins.

Robust Cash Flow & Stable Dividends: Consistent growth in free cash flow supports reliable dividends and opportunistic buybacks.

Gold & Silver Dual Engine: Revenue is highly sensitive to precious metal prices. Over the long run, gold’s role as a safe-haven asset makes WPM a valuable strategic holding.

Growth Tied to New Projects & Production Upside: Expansion comes from securing new streaming contracts and increased output from existing mines.

Exposed to Geopolitical and Price Risks: Mines are largely located in the Americas, with earnings influenced by local regulations, taxation, and commodity price fluctuations.

3. Investment Style: Quality Defensive + Alternative Growth

Quality Defensive: Exposure to gold/silver acts as a hedge against inflation and recession. WPM’s low leverage, no-mining-risk model and long-term contracts enhance downside protection.

Alternative Growth: Precious metals’ long-term bull cycle, future streaming deals, and possible entry into energy transition metals (like cobalt and nickel) provide upside.

4.Trading Strategy

Long-term Hold: Strong fundamentals (cash flow, dividend, debt-free) justify holding as a core defensive asset.

Staggered Entry: With gold prices elevated and WPM trading in a consolidation range, a pullback would offer a better entry.

Watch for Pullbacks Below $85: Offers more attractive risk-reward for new medium-to-long-term positions.

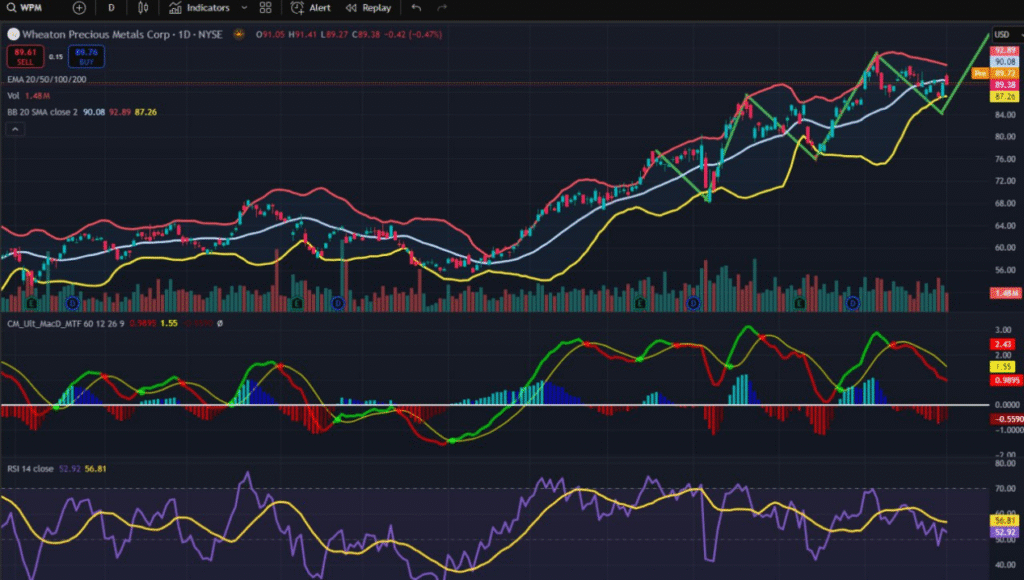

Technical View: Stock is trending near upper Bollinger band with sustained inflows. MACD remains positive, but RSI indicates overbought—suggesting near-term volatility.

5.Summary

WPM represents an excellent combination of “defense and growth,” making it a strong candidate for the core precious metals allocation in a diversified portfolio. It’s particularly valuable during periods of high inflation, elevated interest rates, or broader macroeconomic uncertainty.

While its current valuation may appear elevated, its long-term value proposition remains intact due to the enduring appreciation potential of precious metals, a debt-free balance sheet, and stable dividend payouts — making it a sustainable long-term holding.

We recommend pairing WPM with growth-oriented tech stocks (such as COIN), consumer growth stocks (like COST), and bond ETFs (e.g., TLT) to build a balanced “offensive + defensive” portfolio.

Additionally, a small allocation to cryptocurrencies or innovative assets (such as BTC and ETH) may help capture high-return opportunities. WPM and TLT can serve as hedges against systemic risk, enabling a multi-dimensional approach to balancing returns and risk.