Apollo Alpha Institute

- August 6, 2025

- Posted by: admin@gmail.com

- Category: course

GM dear family

A new day quietly begins may you face every challenge with unwavering faith

On the path of investing every lesson learned every realization is an important step towards becoming a professional

Today we continue with Professor Daniel Rhodes Deep dive into common trading mistakes made by regular investors Correcting cognitive biases from the root enhancing execution skills Building a systematic disciplined and steady investment framework to help you break through in practical applications

Opportunities pass quickly send “AAI” now to get today’s core stock research report and start your efficient day

Stock Market Morning Update

Global stocks rose on Wednesday with European markets giving up earlier gains US stock index futures edged higher as investors assessed President Donald Trump’s latest trade threats disappointing economic data and a range of corporate earnings reports Meanwhile the US Treasury benchmark yield slightly rebounded after hitting a one-month low Investors’ main focus remains on US economic data Wall Street closed lower on Tuesday after data showed that US service sector activity unexpectedly stagnated in July This data reinforced the signals from last Friday’s non-farm payroll report that the US economy is slowing leading the market to significantly increase bets on a Federal Reserve rate cut in September At the same time Trump intensified his trade rhetoric stating that he would impose tariffs on countries purchasing energy from Russia and would soon announce tariffs on semiconductor and pharmaceutical imports However strong corporate earnings and bets on rate cuts are still supporting the stock market

From the Stock Trading Department

GM ladies and gentlemen Let’s officially begin today’s sharing I hope that the investment experiences I’ve gathered over the years can inspire you especially the lessons learned from failures—because those tend to be the ones that truly serve as wake-up calls Dear Apollo Alpha Institute members I sincerely hope that you can avoid the detours I once took and steer clear of the mistakes I made Friends let’s take a moment to think—what are some of the “bad habits” we have in investing Are these habits so ingrained in us that we’ve even come to believe they’re correct

Looking back on my investment journey I often chuckle—because today’s you is just like the “me” from back then Therefore I’ve compiled some common bad habits that many regular investors face and now let’s dive into them together

Common mistakes in investing summarized as follows

1 Chasing prices and panic selling — Many people can’t resist chasing high prices when the stock is soaring only to get stuck right after buying When the price drops they rush to cut their losses only to regret it when the market rebounds losing both money and opportunities

2 Seeking quick gains — Entering the market with the desire to make money immediately driven by short-term speculation without clear investment goals or strategies As a result they trade frequently and deplete their capital through transaction fees and losses

3 Emotional trading — Being driven by market fluctuations panic when prices fall greed when they rise lacking calm analysis and strong conviction and ultimately being repeatedly affected by market sentiment

4 Over-diversification — Holding dozens or even hundreds of stocks which may seem safe but in reality spreads one’s focus and capital too thin with a near-zero probability of profit

5 Over-concentration — Betting heavily on a single stock or industry ignoring the importance of diversification and potentially facing massive losses if negative news arises

6 Lack of patience — Always seeking high returns in the shortest time possible If no profit is made in the short term confidence is lost and they may even give up missing the best opportunity for long-term planning

Friends from Apollo Alpha Institute do any of these habits sound familiar How many of them have you fallen into

When a problem is identified it must be resolved immediately Ladies and gentlemen if the incorrect investment habits I’ve just outlined have caught your attention then now is the time for us to take action

Firstly let’s solve points 1 4 and 5 — it’s very simple From this moment on follow our investment strategy closely and temporarily stop making independent moves Because these common-sense mistakes are ones that professional investors would never make As long as you strictly follow our strategy you will naturally avoid these traps ensuring that your funds are always operating in a safe and efficient manner

Next let’s address points 2 3 and 6 — these require deeper solutions

Point 2 (Quick Profit Seeking) This stems from a one-sided understanding of the market The solution is not just to follow the strategy but to deeply understand our investment logic For example we will clearly tell you the investment attributes of each stock target price and risk control methods Only by truly understanding the logic behind it can you stick to the plan without hesitation

Point 3 (Emotional Trading) Emotional fluctuations mostly happen during the holding period If you have strong investment beliefs and 100% confidence in the trading strategy neither panic nor greed will sway your judgment Learning to hold positions scientifically my friends is the core of stable investment

Point 6 (Lack of Patience) Impatience is often the result of an unstable trading mindset Joining our learning plan is one of the effective ways to adjust this mindset When you truly understand the market and grasp the patterns of fluctuations you’ll realize that patience is the secret weapon for making profits

Ladies and gentlemen this is the first key point I want to share today and it is the core investment principle that the Apollo Alpha Institute relies on for its survival

Please remember—no matter how sharp your investment insight is or how accurate your analysis if you lack good investment habits all of this will be for nothing Unless you decide to never step into the investment market again after making a fortune bad habits will eventually erode your returns and may even plunge you into a deep loss

If you have already realized the seriousness of the issue please take my reminder seriously Spend 30 minutes to calmly analyze yourself and identify the bad habits hidden in your actions one by one Because only by recognizing the enemy first can we completely eliminate them in this battle of investments

If it’s still hard for you to completely change those deep-rooted bad investing habits then please believe me I’m confident enough to tell you that the Smart Investment Cube will be your best partner on the path to becoming an investment expert

It comes from cutting-edge artificial intelligence technology with sharp “neural networks” massive knowledge and data storage and top-level self-learning ability combined with highly accurate automatic decision- making It evolves 24/7 constantly absorbing the latest market information and strategic insights

Its professional investing skills will surpass any human expert Its creation is not just a tech breakthrough but also a milestone in investment history If Elon Musk’s Mars colonization plan is a miracle in human history then the birth of the Smart Investment Cube will become the brightest legend in investment history

At the right time I will share a much longer and more complete introduction about it To me it’s not only my “child” but also an “angel” with a mission carrying the power to make every dream and wish come true Do you still remember the original vision of Apollo Alpha Institute To spread love and hope through investing The Smart Investment Cube will be the ultimate achievement of that mission

Important Notice

This strategy comes from deep analysis and precise calculations We will share the full trading plan and next steps shortly Stay tuned and make sure to follow the latest instructions in real time

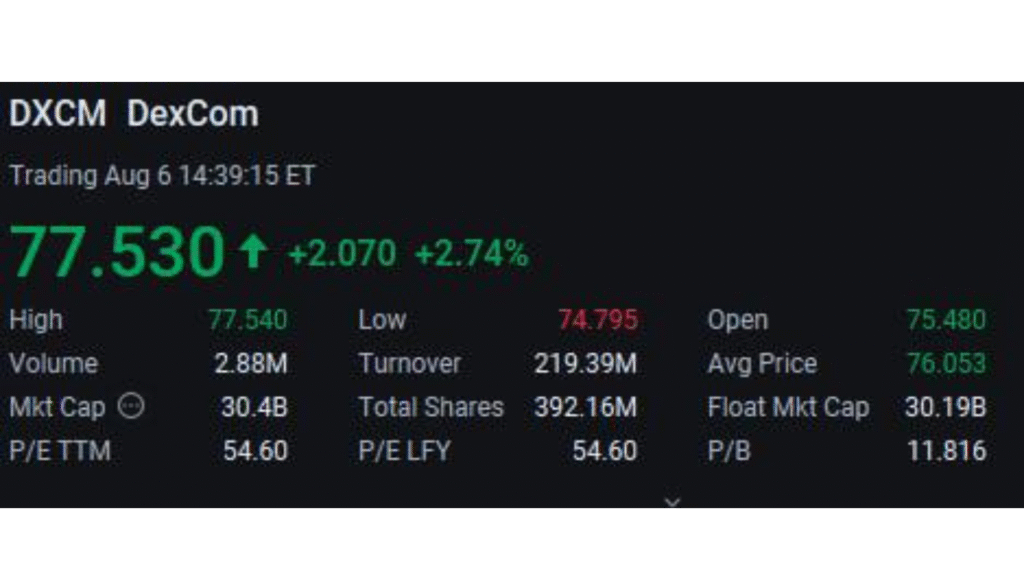

According to the latest urgent instruction from the trading desk DXCM has officially triggered a market buy signal Please execute your buy orders immediately and without hesitation to seize the best timing

DXCM Trading Strategy

Position Size: Keep it at 20% of total funds to stay flexible and manage

risk

Entry: Buy at the current market price now act decisively and don’t

miss the opportunity

Risk Control: Set a stop loss at 71 If it hits exit immediately and stick to

the rules

Take-Profit Plan: Sell in stages

First target 85

Second target 92

Final target 108

Lock in profits step by step and grow gains steadily

Guys stick to the trading desk instructions with no hesitation

Signing the loss-protection agreement is your strongest shield for zero- risk investing making sure every trade is worry-free

Even more exciting the BLSH IPO subscription is in full swing This is a golden chance for all of us apply with full force no hesitation Because maybe on August 13th the listing day you’ll see a return big enough to get your blood pumping

Opportunities don’t wait and fortune favors the bold act now and grab your moment to shine

Bullish is a global digital asset platform driven by institutions focused on building strong and stable market infrastructure and information services fully empowering the core players of the new era of crypto finance

As the digital economy rapidly evolves and crypto assets rise quickly Bullish’s mission is clear create key financial products and cutting-edge tech services help institutions scale empower individual users and speed up the global adoption and deep integration of stablecoins digital assets and blockchain technology

Guys if you believe we are in the golden era powered by both AI and blockchain and that crypto assets will eventually disrupt traditional finance to become a mainstream asset class then Bullish’s growth potential speaks for itself

It represents not just a company but a ticket to the next wave of tech- driven wealth Its performance after listing is worth close attention for every forward-looking investor

Guys why should we always go all in when subscribing to a US IPO The reason is simple

1 Max subscription means a much higher chance to get shares With hot IPOs the more you subscribe the better the system chances you get an allocation It’s all about showing

commitment and determination I don’t want to rely on luck I want to secure my ticket with strength

2 Max subscription also boosts how many shares you get Getting one lot makes you money getting multiple lots makes you big money Think about it if the stock jumps 50% on day one the difference between one lot and five lots is huge That’s multiple times the profit

3 It’s a low-cost battle Many platforms let you pay after you win the allocation so you don’t need to lock up much cash upfront Zero cost to join no-risk trial why hesitate

Bottom line Quality IPOs are the starting point for accelerating wealth and max subscription is how you press the start button first

So I’ll say it clearly BLSH IPO subscription must be maxed out If you get the allocation you might see your money double on listing day

Dear Apollo Alpha Institute members hello everyone

Right now is the golden time to go all in on the BLSH IPO subscription This time we strongly suggest max subscription because it not only gives you a much higher chance to get shares but also the chance to get multiple allocations for bigger profits

BLSH has solid fundamentals strong growth potential and an impressive team From every angle it’s very likely to have a high premium on listing day In simple terms this is almost free profit and you shouldn’t miss it

If you have any questions about BLSH’s business financial data or future outlook feel free to DM me I’ve prepared a full research package and can send it to you anytime Also for everyone joining this subscription round don’t forget to send me a screenshot after you subscribe you’ll not only get a reward but also a chance to join our exclusive raffle The prizes may not be luxury but they come with full sincerity

That’s today’s update Looking forward to your active participation and we’ll see you in our WhatsApp group tomorrow