Apollo Alpha Institute

- August 5, 2025

- Posted by: admin@gmail.com

- Category: course

Good morning, dear family!

A new day quietly begins remember, growth never happens overnight; it’s hidden in every choice you make today to be more determined than yesterday

Yesterday, Professor Daniel Rhodes officially kicked off the 9th Professional Investment Training Program, marking the start of a new stage in our growth journey

Today, Professor Rhodes will introduce a carefully selected high-quality US stock chosen by the Smart Investment Cube system, injecting professional strength and clear direction into your live trading

Our investment journey is unfolding may we walk side by side through knowledge and strategy, steadily climbing toward peak profitability!

Please sign in quickly, reply with “AAI,” and reserve today’s handpicked bull stock!

Stock Market Morning Update:

Global stocks extended their gains for a second consecutive day on Tuesday, with the US dollar stabilizing as investors bet the Federal Reserve will take action to support the economy, alongside strong corporate earnings. European markets rose, boosted by better-than- expected results from BP, DHL, Diageo, and Infineon. Asian markets also gained, with strong service sector data from Japan and China.

US futures inched higher, with the S\&P 500 having recorded its biggest single-day gain since May, driven by dip-buying. Palantir rose over 5% in pre-market trading after beating profit and revenue estimates and raising its full-year outlook. US Q2

corporate earnings grew 9.1% year-over-year, marking the best outperformance since 2021.

Last week’s weak nonfarm payrolls strengthened market expectations for a September rate cut. MUFG sees a 90% chance of a total 75 basis- point cut this year, with rate cut trades replacing previous dominant narratives. Jefferies expects small caps to outperform large tech during the easing cycle and advises investors to adjust portfolios accordingly.

In individual stocks, Pfizer’s Q2 revenue beat estimates, rising over 3% pre-market; Caterpillar dropped more than 4% after missing EPS expectations; Palantir surged 5.5% pre-market to a new high; Fosun Pharma fell over 14% following trial failures; BP’s Q2 profits exceeded expectations, rising 1.7%; AMD gained 1.7% awaiting its earnings report; Chinese gaming stocks rallied with Bilibili and NetEase up over 2%; Futu Holdings rose 1.5% after UBS raised its price target; Daqo New Energy climbed 3.5%; Li Auto rose nearly 2%; Tencent Music gained over 1%.

——from the Equity Trading Desk

Crypto News:

Pi Network Ventures has joined a $20M funding round led by OpenMind, marking its first major investment through its newly launched venture capital fund. The round is seen as a key milestone in the advancement of robotics and AI technologies, aiming to accelerate the development and industrial deployment of humanoid robots. Industry experts believe such moves will speed up tech iteration and reshape labor structures

Executives from Pi Network Ventures stated that the new fund will channel significant resources into tech startups for the first time, saying “investing in innovation within humanoid robotics and AI is one of our core visions”

OpenMind noted that the capital will be used to make humanoid robots more accessible, efficient and intelligent. The company aims to develop a new generation of robots that integrate AI with human collaboration, creating both social and economic value. While project details remain undisclosed, the focus is said to be on breakthrough solutions

Experts widely believe this type of investment will inject powerful momentum into robotics development. However, they also caution that commercialization and widespread adoption will require time and ongoing funding. Economic analysts point out that large-scale investment in tech startups can deliver long-term competitive advantages, though challenges such as long R&D cycles and market validation remain

—–from the Crypto Trading Desk

Ladies and gentlemen, today’s updates are packed with powerful insights

Last week’s nonfarm payrolls came in far below expectations and now the probability of the Fed cutting rates by 75 basis points this year has surged to 90% This suggests the US stock market’s bull run may very well continue under cyclical momentum

At the same time, Pi Network Ventures is going all in on humanoid robotics development, and the future of AI is looking brighter than ever Artificial intelligence isn’t just transforming industries, it’s redefining the global economic system and the future of human civilization Are you starting to see why AI and its related sectors are becoming our top picks for the next phase of stock investing? When the winds of change blow, we all have the chance to soar like eagles And with our Smart Investment Cube, we’re redefining professional investing using the power of AI

In the crypto space, Bitcoin is almost certainly on track to hit $150K this year Looking ahead, spot BTC could break $200K

per coin as it becomes increasingly scarce The crypto bull market is still underway Do you remember the five investment tips I shared last night? One of them was building a diversified portfolio

Bitcoin won’t just be a rare digital asset—it’ll become a collector’s piece symbolizing wealth and status

Important Alert

Please take note

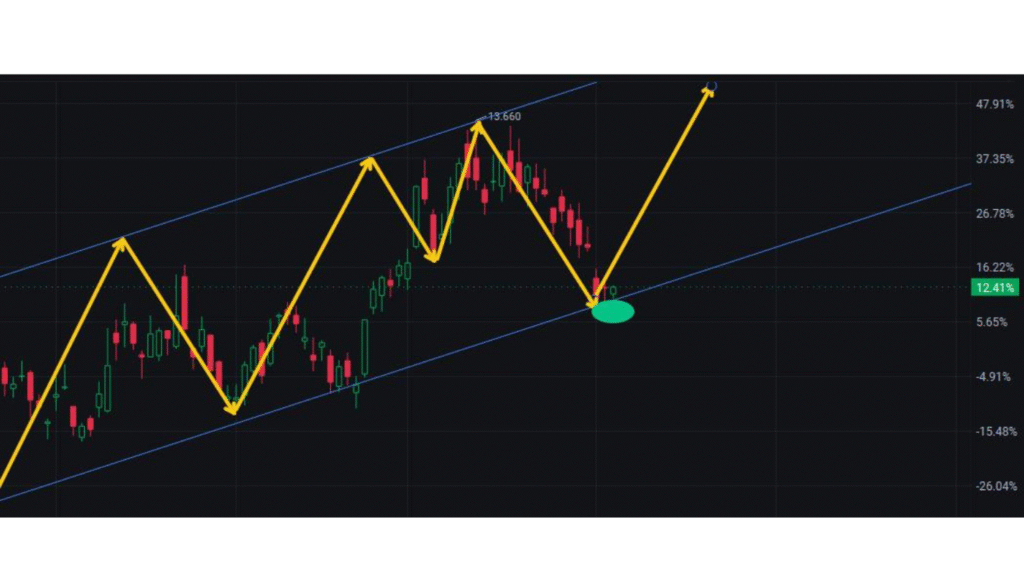

Buy CLSK at current price immediately

Allocate 20% of your total capital — strict adherence to position sizing rules is required

Take Profit targets:

$12.40 $13.50

Stop Loss: $9.80

The magic of investing can light up even the most ordinary nights with wisdom and insight. Friends, when we approach it with focus and intention, it unleashes extraordinary power

Hey friends, did you catch today’s CLSK move? If you want to reap the sweetest rewards in investing, action always comes first, right?

As for CLSK, if you’re curious about the deeper reasoning behind this pick and its exciting future vision, no worries—the stock trading team has prepared a full technical analysis and in-depth research report just for you

DM the assistant now to get your copy. The code to wealth is right here!

A truly outstanding stock often comes with exciting news flow, operates in one of the hottest sectors, and shows explosive strength on the technical chart—these are all key signs of quality picks

CLSK, as a standout in the Bitcoin mining industry, is a benchmark in its field. With the rise of the crypto market in recent years, companies like CLSK are seizing rare and valuable opportunities brought by the times

We firmly believe that artificial intelligence will reshape humanity’s future and drive the birth of a new civilization. In this wave of global digital transformation, the full potential of digital currencies is being unleashed

That’s why CLSK is not just mining digital wealth—it’s participating in the creation of future value within the broader digital economy boom. This is exactly why we stand firmly behind our choice

Everyone, CLSK is about to bring us an unexpected surprise! This high- quality stock, currently sitting near its price bottom, is showing explosive growth potential. As Bitcoin continues pushing toward the $120K milestone, CLSK could ignite like a rocket, breaking free from gravity and soaring sky-high

Please pay special attention to the take-profit levels outlined in the trade instructions—we’ve set three short-term target prices to match different profit-taking rhythms, making it easier for everyone to capture gains flexibly

If you study candlestick patterns, CLSK’s daily chart clearly shows a bottom reversal phase and it’s just starting to gain momentum. What comes next is something truly worth our anticipation

Imagine CLSK as a young tree basking in sunlight and rain, gearing up to grow strong. Give it some time and its upside may surpass anything we expect. What a beautiful sight that would be—wealth, right within reach, don’t you think?

Ladies and gentlemen, when it comes to building a diversified investment portfolio, I hope my thoughts can offer some inspiration

If we could be 100% sure that a single asset is risk-free and guaranteed to make money then diversification wouldn’t matter. But in reality, opportunities like that basically don’t exist. The whole point of diversifying is to lower risk as much as possible while still trying to boost overall returns that’s just common sense

In my view, the core of a solid diversified portfolio right now should be stocks and crypto. After all, what’s more exciting than a bull market?

From a risk management angle, value investing in the stock market still makes a lot of sense. And if you’re looking toward the future, crypto has massive potential. The real question is how do we blend these two asset classes in a way that protects what we have now while still capturing the growth ahead?

Positioning both stocks and crypto at the core of today’s diversified portfolio is not only necessary it’s a highly strategic move

For stock investing, our goal in a bull market is to capture both short- term swing profits and long-term value growth. Friends, take a look at your portfolio have you clearly distinguished between your long-term value stocks and those better suited for mid to short term trading? As long as the bull market continues, disciplined entries typically carry minimal risk and even short pullbacks shouldn’t worry us. I believe CLSK will serve as the perfect example to validate this conviction

On the crypto side, if you already hold Bitcoin, Ethereum or Dogecoin, staying the course is the smartest choice. These assets are the “digital gold” of our time and it’s time that will unlock their true market value

As the global shift toward a digital economy accelerates, the potential value of these assets may well surpass that of gold itself

Ladies and gentlemen, when you’re absolutely clear about why you’ve chosen a stock, that’s when you must stick to your original principles! Conviction isn’t blind stubbornness it’s like a sunflower turning toward the sun as it rises. Why? Because the sun is there right?

*In stock investing, once we’ve done the full analysis and the opportunity appears, we should act decisively. After that, no need to overguess how the market moves we just hold our conviction and trust our strategy*

The market’s future is always uncertain but if we’re equipped to handle the unexpected and we’ve built solid trading habits over time, then there’s nothing to fear

In tomorrow’s session, I might not start with buy or sell techniques. Instead, I’ll take you inside the mind of a trader so we can fix some common investing mistakes Because only when those habits are corrected can technical analysis truly come alive in real trading. Would you find this helpful? Feel free to drop a message and let me know

Want to achieve steady success in stock investing? Following the strategies set by the trading team is your first crucial step

The strategy itself isn’t complicated what’s truly difficult is executing it consistently and accurately. That’s the biggest challenge most investors face, because our thinking, emotions and judgment often don’t align, leading to weak execution

Remember: stock investing like any other asset class is ultimately about earning returns over future time

But many people get it wrong they think if a stock doesn’t go up right after buying, it means the idea was wrong. That kind of short-term mindset is one of the most dangerous traps in investing

The trading team always emphasizes this: strong conviction + enough patience is the real key to riding through market swings and winning long term

Let’s view the market with a professional mindset and use discipline to win with time

US Market Close:

US stocks ended slightly lower Tuesday. The Dow slipped 0.14%, the Nasdaq lost 0.65% and the S&P 500 fell 0.49%. Trump announced plans to sharply raise tariffs on India with pharmaceutical import duties possibly reaching as high as 250%, and said a new chip tariff policy will be unveiled next week

On Monday, the market had rebounded with the S&P 500 up 1.5%, ending a four-day losing streak. The Nasdaq gained nearly 2% and the Dow jumped 585 points

Earnings highlights:

Palantir’s revenue topped $1B for the first time, up 48% YoY

with net profit rising 144%. The company also raised full-year revenue guidance Pfizer beat Q2 revenue expectations Caterpillar missed on EPS BP posted earnings far above forecasts AMD and Snap are set to report after the bell

Macro data:

The US June trade deficit narrowed to $60.2B, the smallest since September 2023 with imports falling 3.7% Last week’s nonfarm payrolls came in well below expectations with downward revisions to previous data, pushing the odds of a 75bps Fed rate cut this year to 90%. MUFG noted that the rate cut cycle is now becoming a dominant theme in the market with a September cut moving from “possible” to “probable”

Stock-specific notes:

Forte Pharma shares dropped after a failed trial

China gaming stocks rose pre-market

Futu had its price target raised to $170 by UBS

Li Auto announced new i8 upgrades with no price hike and plans to

launch the i6 in September

Dear Apollo Alpha Institute members,

That’s a wrap for today’s incredible session from Professor Daniel Rhodes thank you all for your enthusiastic participation! Let’s wait and see how CLSK shines in the market next

Tomorrow, Professor Rhodes will be delivering a value-packed special class A deep dive into the most common yet risky trading habits of everyday investors! This isn’t just about correcting your mindset it’s a key step toward avoiding costly mistakes and building a steadier path forward This might just be the moment you finally break free from those silent profit-killing habits!